A balance sheet is an essential financial statement for any business. It is important to understand what a balance sheet does and how it can reveal information about your business.

1. What is a balance sheet?

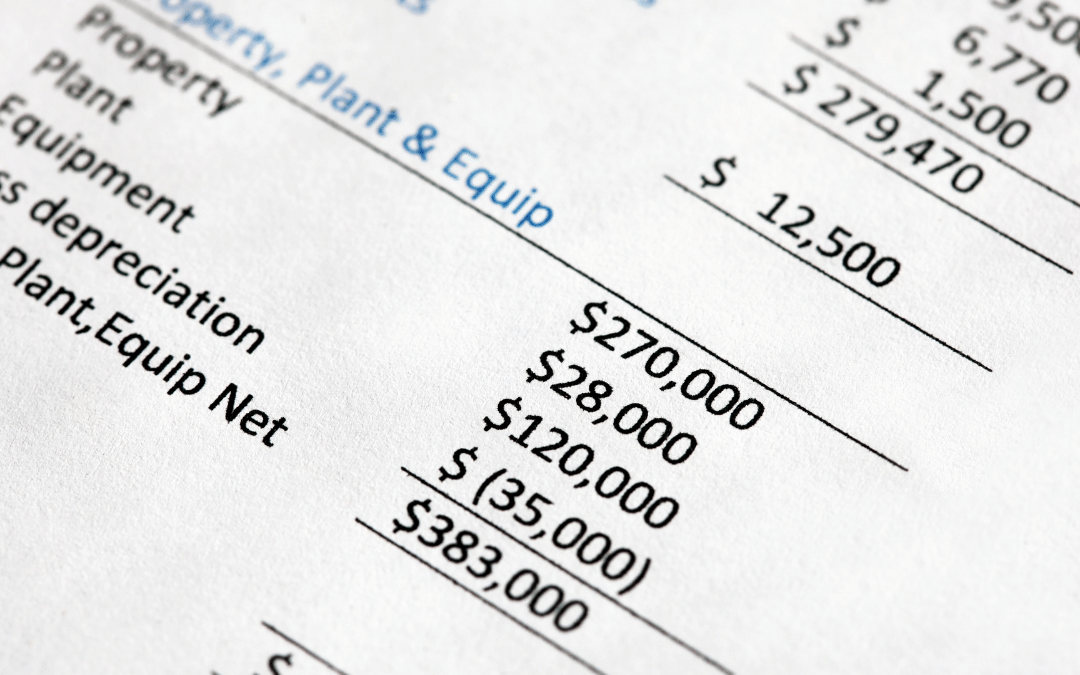

A balance sheet is a summary of the assets and liabilities of a company as well as the owner’s equity at any given time. A balance sheet is typically prepared at the end of set periods (e.g. every quarter; or annually).

Two columns make up a balance sheet. The left column lists the assets. The columns on the left list the assets of the company. The column on the right lists liabilities and owners’ equity. The assets are the sum of the liabilities and owners’ equity. Let’s say that a $1,000 cash contribution by an owner is enough to start a company. Both columns are equal: the company has $1,000 in assets, no liabilities, and $1,000 in owner’s equity. This is the owner’s contribution to the business.

2. Ratio of debt

The balance sheet gives a snapshot of the financial health of the company. The debt ratio is one of the most important indices. It is calculated by comparing total assets to total debts. To get a percentage, divide total liabilities and total assets. If assets are $100,000 and debts are $55,000, then the debt ratio is 55% (55,000 / $100,000).

Your assets may be able to cover your debts. However, it is not recommended that you have too many debts relative to company assets. The higher the debt ratio, the greater the company’s leverage. If a company has too high a debt ratio, it could cause problems. The industry determines the acceptable level of debt.

3. Owner’s equity

Owner’s equity, in a broad sense, is what owners would have after all liabilities are paid. It is what you have put into the business.

- Equity is the owner’s total investment in the business, including cash and property, less any withdrawals (e.g. a monthly draw to pay personal living expenses).

- Owner’s equity can also be called shareholder equity in the case of a corporation. It is the sum of retained earnings and corporate stock (undistributed amounts). You can make other adjustments.

Read: What do earnings reports mean?

The owner’s equity compares from one period to another and shows how your investment is performing. If equity falls, it’s time to examine the situation and make adjustments. You might need to pay off any outstanding debts or reduce the liabilities shown on your balance sheet. It’s good to see the owner’s equity grows.

David Rewcastle of Darien, Connecticut, is an Equity and Fixed Income Analyst with a background in Finance and Middle East Studies.