Credit agencies, lenders, vendors, and suppliers can use a business credit score to get a general idea about how trustworthy you are in borrowing money. A higher business credit score is similar to your personal credit score. It tells potential lenders that you are more creditworthy. Continue reading if you are a business owner looking to build strong business credit.

What is a business credit score and how do you calculate it?

A business credit score is just what it sounds like: it’s a credit score that applies only to businesses and not individuals. Business credit scores are generally determined using information from a credit report. This can include information about the company, such as the number of employees, historical data about the business, past payments history and amounts owed.

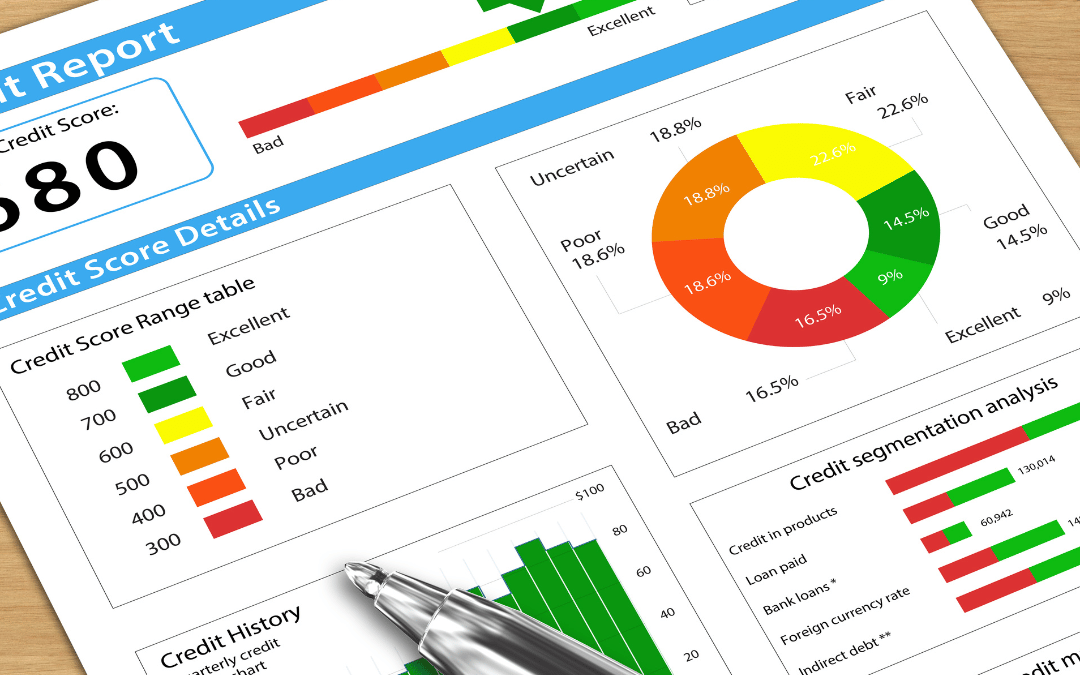

You’ll notice that business credit scores don’t fit in the same numerical ranges as personal credit scores. Most business credit scores are ranked from 0-10, while scores for small businesses using the FICO SBSS (FICO Small Business Scoring System) range between 0 and 300.

Read: What do earnings reports mean?

A business credit score has many benefits

Small business owners can benefit from a strong credit score.

- Your personal finances are distinct from your business finances. A business credit score will allow you to access credit for your company without having to rely on your personal credit. This is a great help when you need to file your taxes every year. The U.S. tax system requires you to keep your personal and business finances separate if you intend on deducting expenses. This separation can help you ensure that your personal assets don’t get leveraged against your business in the event of financial problems.

- It is much easier to get financing. You can get business loans at lower rates if you have good credit. You won’t be required to sign a personal guarantee if you apply for a loan for business purposes.

- Rates for insurance policies may be lower. For a growing company, insurance rates can be very high. A good credit score can help you get low rates for your business.

There are differences between business and personal credit scores

There are many differences between your personal and business credit scores. These include the following:

Credit scores for businesses are lower on a smaller scale

Personal credit scores are typically between 300 and 850. Business credit scores are anywhere from 1 to 100.

Anybody can access a business credit score

Personal credit scores can only be accessed for specific circumstances. However, anyone can access a business credit score to check how a company ranks.

Different factors are used to determine business credit scores

The following factors are used to determine business credit scores: industry risk, company size, payment history, credit mix, debt and usage, industry risk, and age of credit. Different factors are used to determine personal credit scores: payment history; the amount of debt, new credits, credit mix, and average credit history.

Your Employer Identification Number (EIN), is used to score business credit.

Your personal credit score is linked to your Social Security number. However, your business credit score can be tied to an EIN. This allows you to keep your personal financial information confidential while building and maintaining your business credit score. To obtain an EIN, you will need to register your business legally.

How is business credit calculated?

Your business credit score is based on your payment history. This includes whether you have made sufficient timely payments to your debts. Your company’s age is a factor in your business credit score. You may get a higher score if you have been around for a longer time. When calculating a business credit score you should also consider debt and debt usage, along with the industry and size of your company.

How to assess your credit score for business

It’s possible to have a free view of your personal credit score by using many platforms. However, this is not true for business credit scores. You may have to pay for a business credit score, whether it’s for your business or another.

Below are details about how to check your credit score for business with each credit reporting agency that determines business credit scores: Experian, Equifax, Dun & Bradstreet.

David Rewcastle of Darien, Connecticut, is an Equity and Fixed Income Analyst with a background in Finance and Middle East Studies.